Unlocking Opportunities: Your Guide to Buying a Forex Company

Investing in a forex company for sale can be one of the most lucrative decisions you can make in today’s financial landscape. With the rise of digital trading platforms and a growing global economy, the foreign exchange (forex) market has emerged as a premier avenue for significant financial gains. In this article, we will explore various aspects of buying a forex company, including its benefits, key factors to consider, and the process involved. Let’s dive deep into why this might be a great avenue for your investment portfolio.

Understanding the Forex Market

The forex market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion. It operates 24 hours a day across different time zones, making it accessible to traders worldwide. The primary participants in this market include:

- Central Banks: They implement monetary policies, control interest rates, and influence exchange rates.

- Commercial Banks: Major institutions engage in trading to manage their financial assets and liabilities.

- Corporations: Businesses that operate internationally engage in forex to hedge against currency fluctuations.

- Retail Traders: Individual investors using platforms to trade currencies can generate profits.

The Advantages of Investing in a Forex Company

Buying a forex company for sale presents numerous advantages, including:

1. Established Customer Base

Purchasing a forex company often means acquiring an established customer base. This can significantly reduce the time and effort needed to attract new clients. An existing clientele enhances the company's cash flow and provides a foundation to build upon.

2. Proven Business Model

Established forex companies have a tested business model that highlights their operational strengths and weaknesses. Learning from their past performance can guide your management strategies and enhance profitability.

3. Immediate Revenue Streams

When you invest in a functioning forex company, you can benefit from immediate revenue streams. This is particularly advantageous compared to starting from scratch.

4. Enhanced Market Knowledge

Acquiring a forex company often comes with invaluable market insights. Companies typically have access to resources, industry reports, and customer analytics that can improve decision-making.

5. Competitive Advantage

By entering the forex industry through acquisition, you may gain a competitive edge over startups, which may face challenges in developing brand recognition and customer trust.

Key Factors to Consider When Buying a Forex Company

While the benefits are substantial, there are also critical considerations to take into account:

1. Regulatory Compliance

Forex trading is highly regulated worldwide. Before purchasing, ensure that the forex company complies with all relevant regulations. This includes obtaining necessary licenses and adhering to local financial regulations.

2. Financial Health

Conduct thorough financial due diligence. Review financial statements, profit and loss reports, and cash flow records to assess the company's profitability and sustainability.

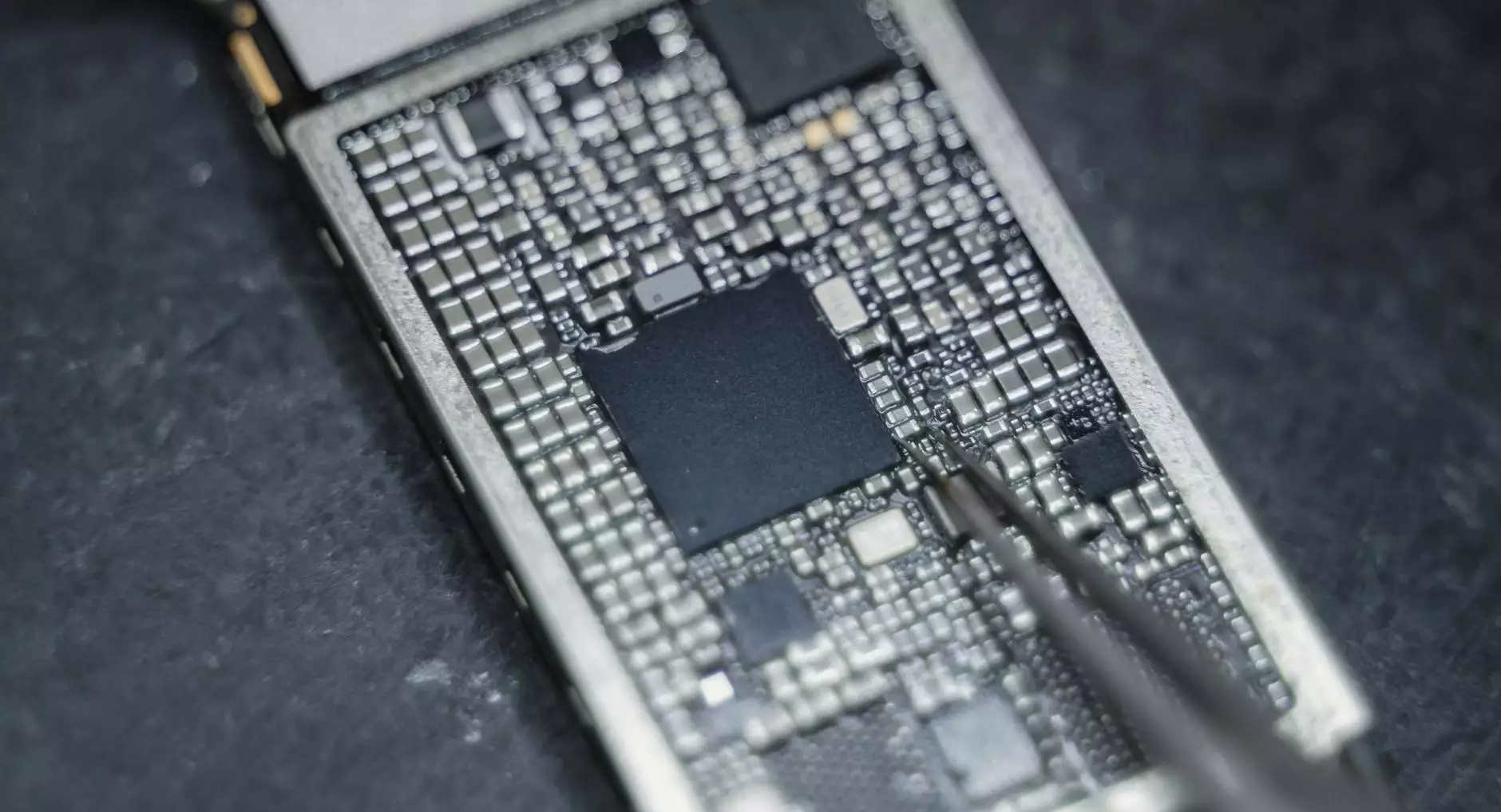

3. Technology and Platforms

The technology behind the forex trading platform is critical. Evaluate the trading software, user experience, and cybersecurity measures in place. An outdated or faulty platform can drive clients away.

4. Brand Reputation

Conduct a comprehensive analysis of the company’s reputation. Online reviews, industry feedback, and client testimonials can provide insights into its standing within the forex market.

5. Staff Expertise

The success of a forex company largely depends on its team. Assess the expertise and experience of current staff. Strong leadership and a knowledgeable workforce are key for future growth.

Steps to Purchase a Forex Company

1. Research

Your journey begins with extensive research. Identify potential forex companies that align with your investment goals. Websites, listings, and market analysis platforms are great resources.

2. Evaluate Options

After identifying potential candidates, evaluate them based on the factors mentioned above — regulatory status, financial health, and technology.

3. Due Diligence

Engage in due diligence to scrutinize every aspect of the business. This includes reviewing documentation, understanding liabilities, and consulting with industry experts.

4. Negotiation

Negotiating the terms of purchase is vital. Ensure that all aspects of the deal are consensual and benefit both parties involved.

5. Finalize the Deal

Upon agreeing to terms, the legalities come into play. Involve legal professionals to draft contracts that seal the agreement legally. Once finalized, the transfer of ownership will occur smoothly.

Post-Purchase Strategies for Success

After acquiring a forex company for sale, several strategies can ensure long-term success:

1. Client Retention Strategies

Engage with existing clients and understand their needs. Offering personalized services and maintaining strong communication can enhance client loyalty.

2. Market Expansion

Consider geographic and demographic expansion. Explore new markets where forex trading is gaining traction for sustainable growth.

3. Technological Investment

Invest in upgrading technology. Incorporating new trading tools, mobile apps, and customer support systems can improve user experience.

4. Marketing and Branding

Revitalize your marketing strategy. A strong branding approach that highlights your value proposition will attract new clients and strengthen your market position.

5. Continuous Learning and Adaptation

In the dynamic forex market, continuous education is crucial. Stay updated with market trends, economic news, and technological advancements to make informed decisions.

Conclusion

Investing in a forex company for sale is not merely a financial decision; it is an opportunity to be part of a vibrant and dynamic market. The potential for earnings, the established structures in place, and the access to a significant client base can lead to enormous returns on investment. With careful planning, thorough research, and a forward-thinking approach, you can navigate the complexities of this industry and emerge as a successful forex entrepreneur.

For more insights and professional guidance on acquiring a forex company, visit eli-deal.com for expert assistance.